What’s in a Name? ESMA publishes Final Guidelines on Funds’ Names using ESG or Sustainability-Related terms

In recent years, the surge in demand for sustainable investment funds has been accompanied by a growing concern surrounding "greenwashing".

The European Supervisory Authorities (EBA, EIOPA and ESMA - ESA’s) consider greenwashing “to be a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile or an entity, a financial product, or financial services”. This practice of misleadingly presenting a company or fund as environmentally friendly, is problematic as it can be misleading to consumers, investors or other market participants.

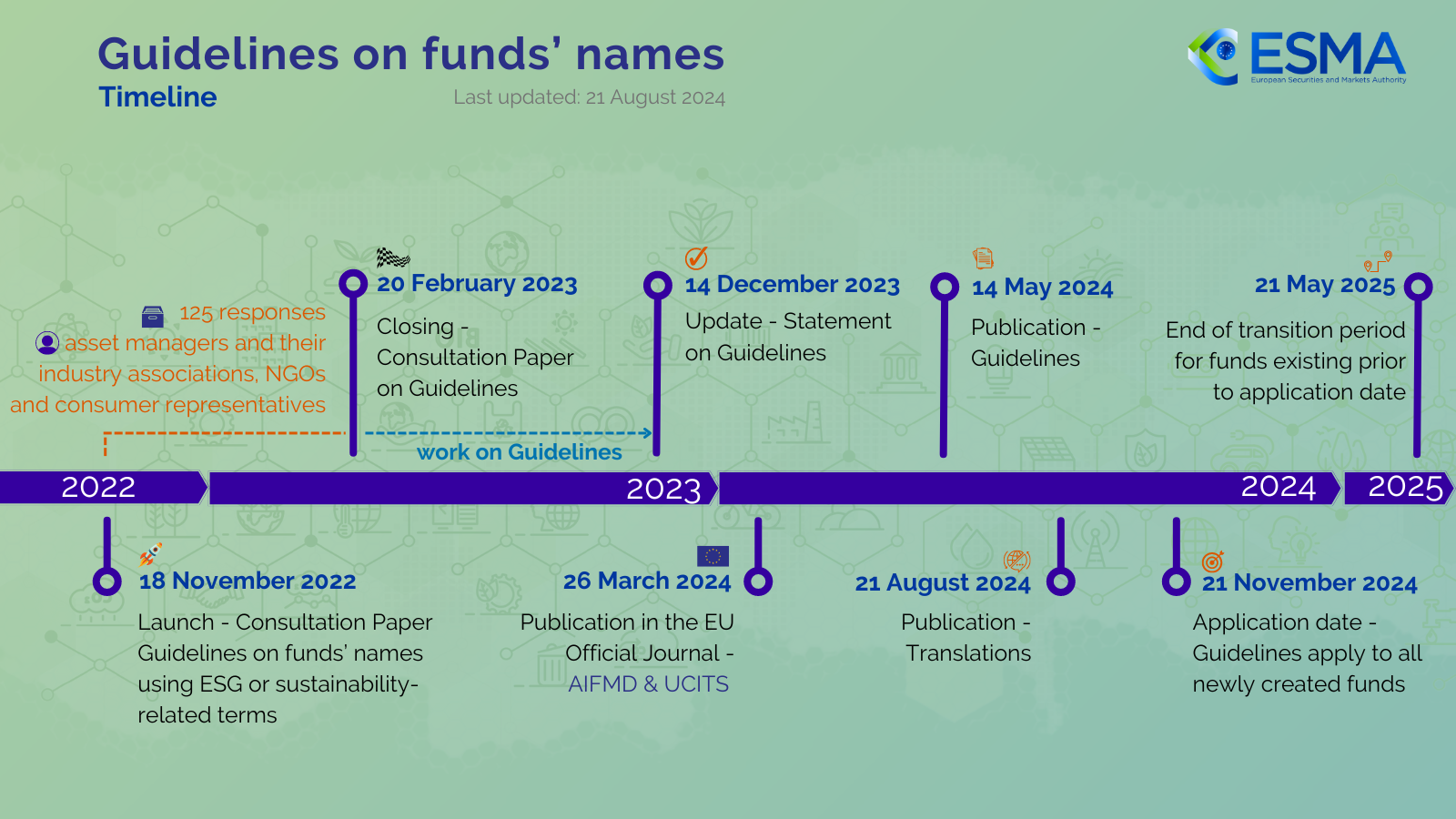

The final guidelines on funds’ names using ESG or sustainability-related terms aim to mitigate the risk of misleading sustainability claims and disclosures. It addresses situations where fund names are labeled as green or socially sustainable without being substantiated by objective standards. These guidelines seek to enhance transparency and accuracy in the financial industry by ensuring that the use of ESG and sustainability terms aligns with measurable criteria and credible practices.

While ESMA recognises the importance of investors delving into a fund's comprehensive disclosures, they strongly believe that the name of a fund holds considerable sway over the investment choices made by investors.

The guidelines make a distinction in the terminology used in the names. The distinction is between transition-, social-, and governance-related terms, or environmental- or impact-related terms, or sustainability-related terms. For example, funds using transition-, social- and governance-related terms should meet an 80% threshold linked to the proportion of investments used to meet environmental or social characteristic or sustainable investment objectives in accordance with the binding elements of the investment strategy as disclosed according to Annexes II and III of the Commission Delegated Regulation 2022/1288 (Commission Delegated Regulation SFDR).

Note that it is a part of a wider obligation of funds (Alternative Investment Funds (AIFs) or Undertakings for Collective Investment in Transferable Securities (UCITs)), not to act in a manner that makes their marketing unclear, unfair, dishonest, or misleading. Adhering to these standards ensures transparency and trust within the financial sector.

Read more:

Sovereign wealth funds (SWFs) are gaining significant traction around the globe, emerging as powerful tools for governments to manage their financial reserves and invest for the future. Among these funds, the Public Investment Fund (PIF) of Saudi Arabia stands out as a crucial catalyst propelling the nation towards a new era of economic diversification and growth.