Don't Pop the Champagne Yet: Risks Lurk Beneath the Positive Global Financial Outlook

The April 2024 IMF Global Financial Stability Report (GFSR) reveals the overall sentiment on the global financial system and the latest key vulnerabilities.

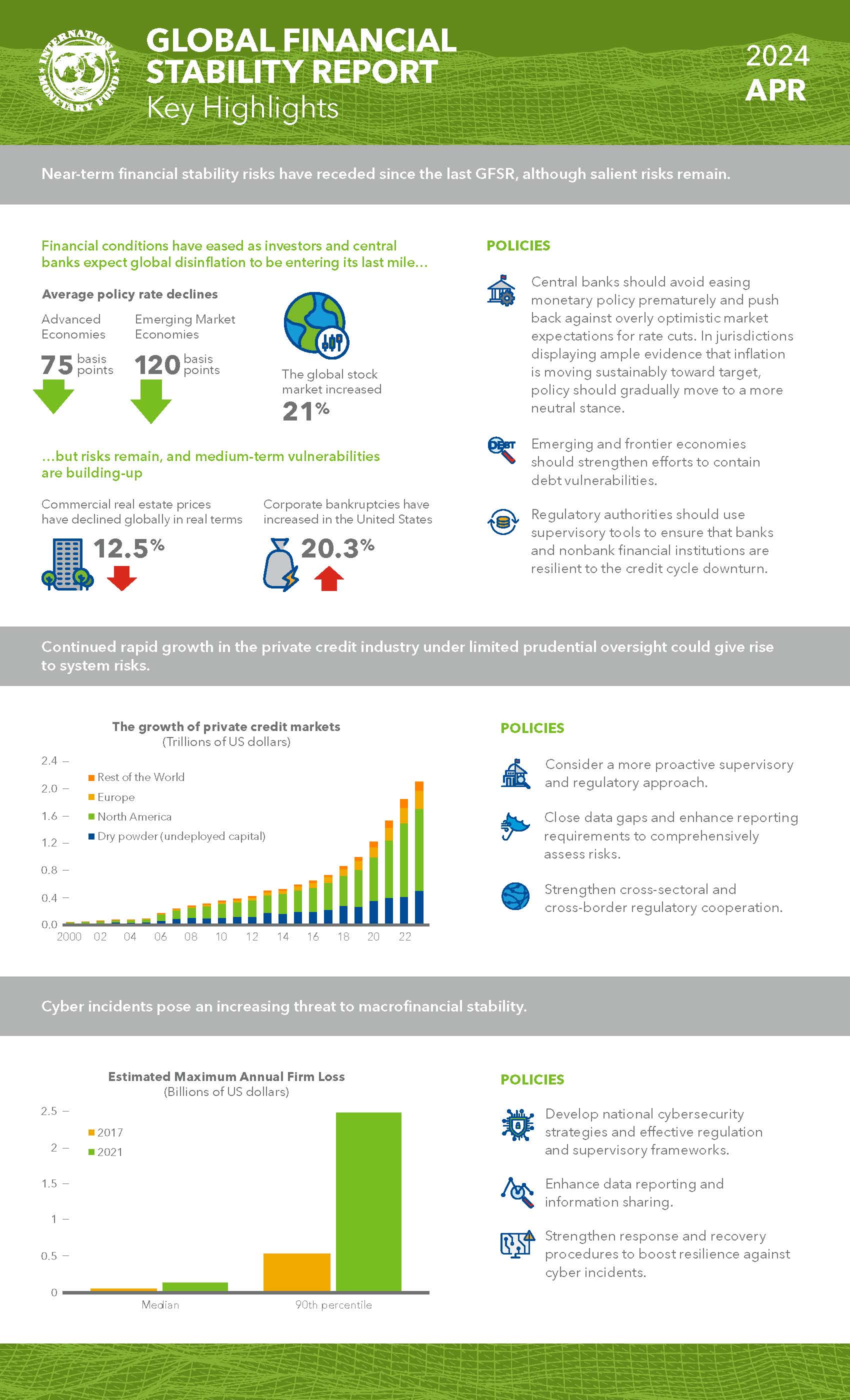

Financial Fragilities Along the Last Mile of Disinflation?

The narrative is positive. Global sentiment expects a soft landing for the global economy. The report observes that interest rates have gone down worldwide, stocks have been up 20 percent globally, and the difference in interest rates between government and corporate bonds has narrowed. However, vulnerabilities threaten this positive scenario, including the decline of commercial real estate prices and the increasing accumulation of both public and private debt, which might turn the tide. Therefore, the report warns against premature monetary easing and overly optimistic policy rate cuts by central banks. Authorities should also strengthen efforts to contain debt vulnerabilities, and supervisory and regulatory authorities should use appropriate tools to ensure that banks and non-bank financial institutions remain resilient.

The Rise and Risk of Private Credit

Corporate private credit has become a rapidly growing asset class, rivaling other major credit markets in size. These loans are provided mostly to firms that are too large or risky for banks and too small for public markets.

The report warns of financial stability risks arising from relatively fragile borrowers, increased exposure of pensions and insurers to this asset class, a growing share of semi-liquid investment vehicles, multiple layers of leverage, outdated valuations, and unclear interconnections between participants. The fact that the private credit market is not very transparent poses risks if it grows exponentially under limited prudential oversight, potentially leading to systemic risks for the system. The IMF recommends a more intrusive regulatory and supervisory approach for this risk.

Want to know more about private credit funds? Read this extensive blog article: “The Rise of Private Credit Funds and the New EU (AIFMD) Rules”.

Cyber Risk

Cyber risk has been increasing as the number of cyberattacks has almost doubled since the COVID-19 pandemic. The financial sector is especially vulnerable, as nearly one-fifth of all incidents affect financial firms. Due to technological and financial interconnectedness, severe cyber incidents at major financial institutions can potentially pose a direct threat to macroeconomic stability through a loss of public confidence and the disruption of critical services. Therefore, the report recommend that policies and oversight on cybersecurity and resilience be strengthened and adequately developed.

source: IMF April 2024 GFSR

You might also be interested in: